Watch the video and review the accompanying documentation below to learn more about leveraging Direct Pay in our area.

Leveraging Direct Pay in New England

Claiming Direct Pay for Non-Profits and Communities

Samantha Jacoby

Deputy Director of Federal Tax Policy, Center on Budget and Policy Priorities

June 11, 2024

Disclaimer

This presentation provides an overview of Treasury/IRS guidance and Inflation Reduction Act tax credits and is intended for general informational purposes only and does not constitute legal or tax advice.

Please refer to Treasury/IRS guidance for more detailed information.

Overview

Background on Inflation Reduction Act tax credits and direct pay

Process for claiming credits through direct pay

Example Projects and Tax Credits

- Solar roofs on non-profit-owned buildings that lower the cost of energy

- Investment tax credit covers 30% of project costs

- With bonus credits, can cover up to 70% of costs

- Electric vehicle fleets to replace aging gas-powered vehicle fleets

- EV credit covers up to 30% of commercial vehicle cost (up to $7500 for small vehicles, $40,000 for large vehicles)

- 30% credit for charging infrastructure, up to $100,000

Direct Pay Background

- Direct pay allows non-profits, governments, agencies, and other tax-exempt entities to access the full value of tax credits via a tax refund

- Program is uncapped, available for 10 years

- No competitive application process

- Requires entities (1) to pre-register projects with the IRS and (2) to file a tax return

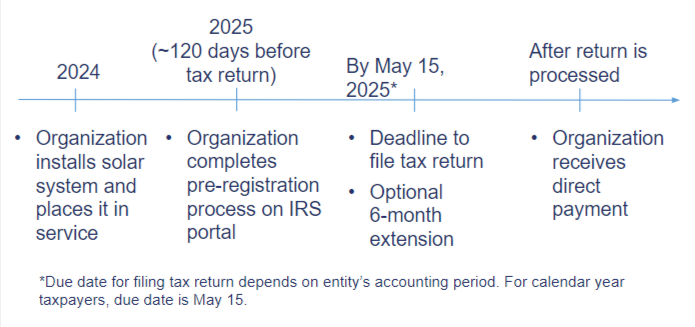

Sample Timeline: Using Direct Pay to Receive Solar Tax Credits

Putting It Together: Financing Local Clean Energy Projects

- Time lag from project development to receive of direct pay tax refund 🡪 projects will require bridge financing

- Credit stacking with other financing tools, e.g., grants and forgivable loans up to 100% of project costs

- Using other IRA tools: Greenhouse Gas Reduction Fund, Solar for All

Existing green banks

Helpful Resources

IRS Direct Pay FAQs:

https://www.irs.gov/credits-deductions/elective-pay-and-transferability-frequently-asked-questions-elective-pay

Final Direct Pay regulations:

https://www.govinfo.gov/content/pkg/FR-2024-03-11/pdf/2024-04604.pdf

Pre-Registration User Guide:

https://www.irs.gov/pub/irs-pdf/p5884.pdf

Pre-Registration Portal:

https://www.irs.gov/credits-deductions/register-for-elective-payment-or-transfer-of-credits

Direct pay resources from Lawyers for Good Government:

https://www.lawyersforgoodgovernment.org/elective-pay-ira-tax-incentives